Construction Forecast

Strong Growth in Nonresidential Building Spending Projected in 2023

by the American Institute of Architects

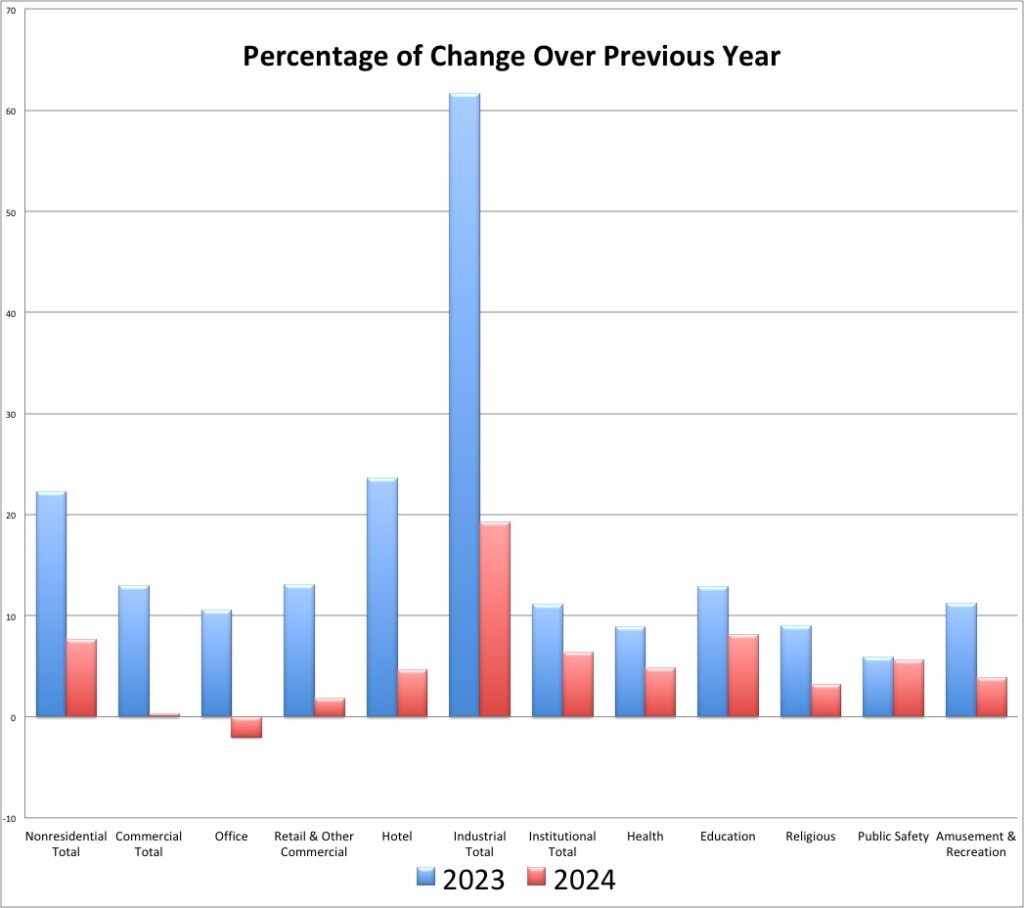

The American Institute of Architect’s (AIA) Consensus Construction Forecast panel has optimistic projections for nonresidential building spending in late 2023 and beyond, and the news is generally positive, with a caveat. The panel, comprised of leading economic forecasters, is projecting that spending on buildings will increase by 20% this year, a torrid pace not seen since the construction boom years leading up to the Great Recession.

“The forecast for nonresidential construction activity remains healthy through the second half of 2023 and into 2024,” said AIA chief economist Kermit Baker, PhD, Hon. AIA. “The industry got off to an extremely strong start in the first half of the year, and that momentum will ensure healthy gains for the year before moving to a much more moderate pace of expansion in 2024.”

Leading the charge is the manufacturing sector, where spending is projected to increase more than 50% over last year’s exceptional performance. Healthy gains are expected across all sectors, including commercial, institutional, and industrial construction categories, with each projected to increase at a double-digit pace.

Though spending on nonresidential buildings increased by more than 10% last year, once inflation is factored in, real increases were much lower. This means that while companies are investing heavily in new buildings and renovations this year, their investments may not translate into comparable economic growth or employment opportunities. However, with inflation in construction moderating, there is optimism among industry professionals about what lies ahead for nonresidential building projects this year and beyond.

However, after the surge this year, market spending growth is expected to come back to earth in 2024. Forecast panelists are calling for a modest 2% increase in overall building spending next year, with a projected modest decline in the commercial sector, a 4% increase in spending on institutional facilities, and even just a 5% increase in the currently red-hot industrial sector.

Inflation Fight Continues

Inflation in construction costs continues to be an issue, though it has moderated significantly in recent months. Overall inflation in the economy has dropped dramatically over the past year, from over 9% compared to year-ago levels in mid-2022 to around 4% at present. However, the Federal Reserve Board’s battle on the inflation front is far from over as further declines will be much more difficult to realize.

The same is true for construction costs. Though following a similar pattern to overall consumer price inflation, they have been even more extreme. While the annual increase in the CPI never hit double digits this cycle, the increase in producer prices for construction inputs was in excess of 20% from mid-2021 through the spring of 2022. Recently, year-over-year changes in prices of key construction inputs have turned negative, due to the volatility of some construction commodities and the elevated comparisons from a year ago. Prices for lumber and plywood as well as steel mill products are below where they were a year ago. Both had seen dramatic spikes in prices earlier in the pandemic. While construction commodity prices are likely to remain volatile moving forward, some will fall while others rise, keeping overall commodity input costs to construction in a much narrower range.

Salaries and services costs are a different story. While commodity pricing has been volatile, construction wages have been slowly creeping up, and are now about 6% above year-ago level. The same is true for architecture and engineering services provided to the construction sector, but to a lesser degree. The prices of all of these inputs will be harder to reverse since compensation and other costs of service providers tend to change only very slowly.

Setting the Pace

Within the expected strong performance in building activity in 2023 lies an unusual amount of projected variability by construction sector. Stronger future commercial/industrial categories are expected to include manufacturing, distribution, and hotels. On the institutional side, healthcare and education are expected to perform well.

The strong growth in spending on manufacturing facilities is largely attributed to the reshoring of production resulting from supply chain nightmares during the pandemic. Indeed, the pandemic did encourage many producers to shift some of their activity to domestic sources, but much of the growth was due to other motivations. Last year, 1/3 of industrial construction was related to computer, electrical, and electronic equipment, while over a 1/4 was for chemical facilities.

There are emerging concerns that outsourcing the manufacturing of high-tech products leaves our economy and national defense more vulnerable. The $280 billion in funding provided by the 2022 federal CHIPS and Science Act is designed to advance domestic research and manufacturing of semiconductors in the United States. These funds will boost spending for these facilities for much of the coming decade.

The growth in chemical manufacturing facilities likewise is only marginally related to reshoring activities. Pharmaceuticals account for a sizeable share of production in this sector, but plastics have recently come to dominate this category. Growth in manufacturing facilities here has more to do with the recent growth in domestic gas and oil production in the United States, and the competitive advantage of producing plastics from these inputs domestically rather than shipping the oil and gas to foreign markets for the production of these products.

Distribution facilities have helped generate growth in an otherwise weak retail sector. Last year, warehouses accounted for 58% of construction spending in the broader retail and other commercial category. Retail facilities accounted for only 12%, while food and beverage facilities accounted for 9%. Spending on warehouses increased 26% last year, pulling up the broader sector.

However, moving forward, growth in spending on distribution facilities is expected to moderate. The growth in e-commerce activity has slowed since the pandemic, and spending will increasingly be focused on automating existing facilities rather than building new ones.

Due to a dramatic reduction in both business and leisure travel during the pandemic, the hotel construction market was one of the most decimated sectors. Construction spending on hotels declined 15% nationally in 2020, and another 33% in 2021 before making a modest recovery of just under 4% in 2022. The Smith Travel Group reports that key metrics for the hotel industry have steadied and are beginning to improve. The daily average occupancy rate has stabilized at just under 65%, while the revenue per available room has increased almost 4% over the past year. As a result, the AIA Consensus Forecast panel is projecting a 24% increase in construction spending on hotels this year, and an additional 7% in 2024.

Institutional Markets

Institutional construction sectors tend to be more stable across the construction cycle, with smaller losses during downturns and smaller gains during expansionary periods. Within this broader pattern, however, the two largest institutional building sectors have seen surprisingly strong growth so far in 2023. Through May, spending on healthcare facilities has increased almost 14% from year-ago levels, while spending on educational facilities is up over 6%.

Healthcare has been one of the few building sectors that continued to see gains during the pandemic. While utilization rates increased during the pandemic, more fundamentally, national demographics point to continued gains in health care spending as the aging Baby Boomer generation will ensure a continued increase in spending on health care services. The AIA Consensus Forecast panel is projecting spending growth in excess of 10% for healthcare facilities this year, and an additional 3% in 2024.

Unlike healthcare, spending on education facilities declined during the pandemic as remote education reduced the need for the expected renovation and expansion of educational facilities. ConstructConnect® reports that the value of construction starts for junior high and high school facilities increased 20% through the first five months of this year, college and university facilities starts are up 14%, while preschool and elementary facilities have increased 9%. While the pace of growth in this sector is expected to slow just a bit over the remainder of the year, the AIA Consensus Forecast panel expects spending in the educational construction sector to increase 10.5% for the year, and another 4.3% next year.

The Impending Slowdown

The first half of this year has seen gains in construction spending on nonresidential buildings approaching 20%. However, this scorching growth rate is expected to moderate a bit moving into the third and fourth quarters. Even with the easing in supply chain issues and the improved pricing of many construction materials and products, elevated interest rates, more restrictive lending on the part of banks, nervousness over the direction of the economy, and construction labor constraints are expected to slow the pace of growth.

We have already seen design work at architecture firms ease over the past year. In the first half of 2022, the AIA/Deltek Architecture Billings Index averaged an impressive 53.6, suggesting strong growth in design activity. By the third quarter the average index score declined to 51.7, and for the fourth quarter it dropped to 48.1, pointing to a modest decline in design activity nationally. So far in 2023, monthly scores have remained below 50 on average, pointing to continued softness in design activity. Given its normal 9–12-month lead over construction spending, that suggests that spending gains should begin to moderate around now, and begin to decline on a monthly basis in the third or fourth quarter of this year.