Adding Value

Survey Highlights Trends in Kitchen & Bathroom Design

by the American Institute of Architects

New data from the American Institute of Architects (AIA) Home Design Trends Survey is revealing the latest trends in kitchen and bathroom design. Demand for kitchen related home features, such as working pantries and outdoor kitchens has remained desirable. Induction cooking appliances are becoming much more prevalent and topped the list of kitchen products growing in popularity.

Bathrooms remain a popular focus, as more upscale features like larger walk-in and doorless showers, towel-warming drawers, and stall showers without bathtubs top the list of desirable features. Additionally, there was accelerated demand for more easily accessible bathroom features such as no threshold showers and smart toilets.

“The design focus on home kitchens and baths continues, but homeowners are being mindful in making sure the upgrades make economic sense in the current economic environment,” said AIA chief economist Kermit Baker, PhD, Hon. AIA. “The entire residential sector is under pressure, and high borrowing costs and uncertain future home prices are making households more cautious about undertaking new projects.”

Findings of the report also revealed residential architecture firm business conditions for the fourth quarter of 2022, which included: project billings, inquiries, and design contracts ended 2022 showing weakness; project backlogs at residential architecture firms continued to decline from their peak in Q1 of 2022 but remained near all-time highs in Q4; and residential firms in all regions reported weaker business conditions in Q4 of 2022. The AIA Home Design Trends Survey is conducted quarterly with a panel of more than 300 architecture firms that concentrate their practice in the residential sector.

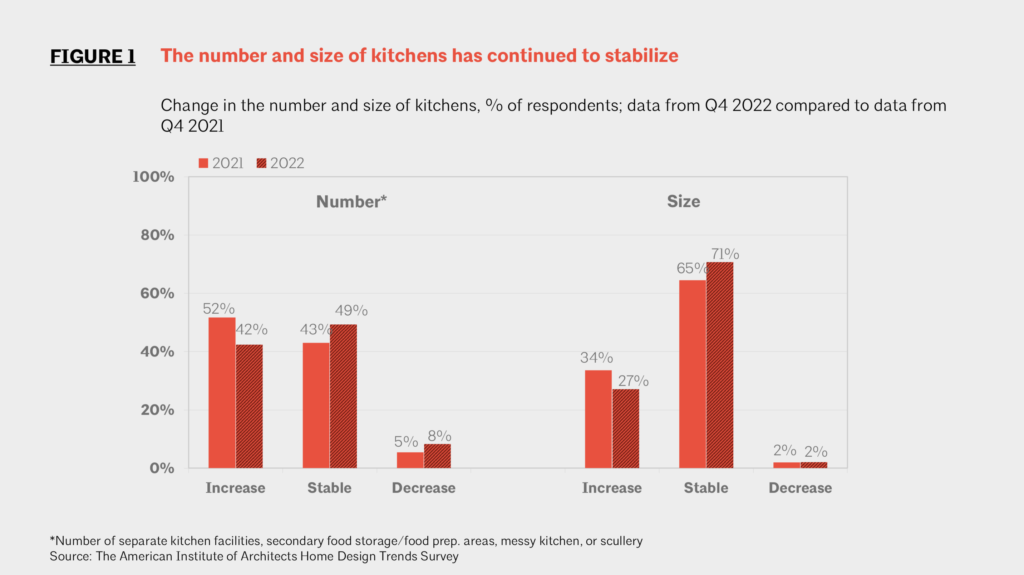

The number and size of kitchens has continued to stabilize. The change in the number of separate kitchen facilities, secondary food storage/food preparation areas, messy kitchens, or sculleries in Q4 2022 show 42% of respondents increased the size, 49% remained stable, and 8% decreased the size. The size of kitchens in Q4 of survey respondents showed 27% increased the size, 71% remained stable, and 2% decreased the size.

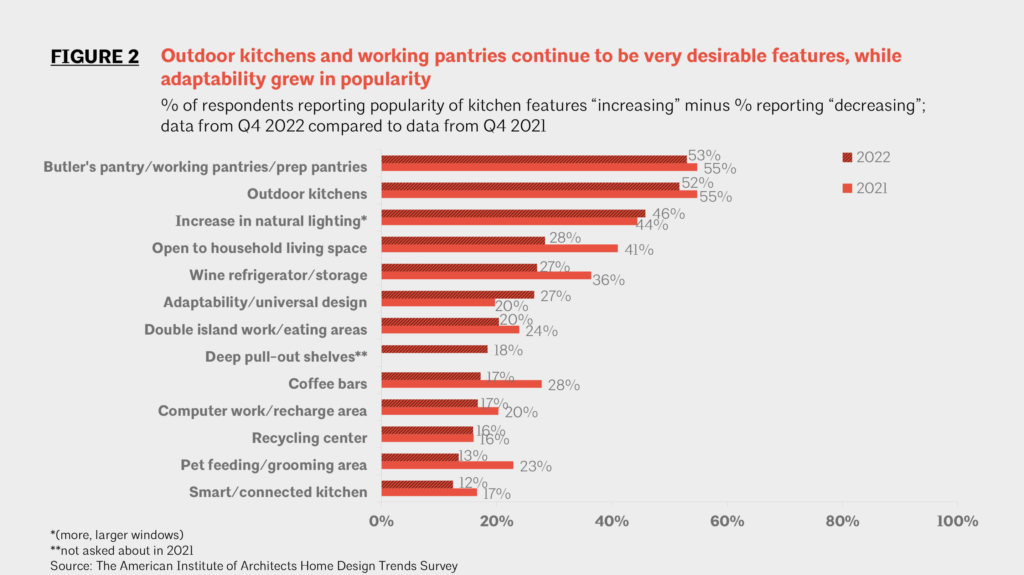

Outdoor kitchens and working pantries continue to be very desirable features, while adaptability grew in popularity. The percentage of respondents reporting popularity of kitchen features increasing minus the percentage reporting decreasing, using data from Q4 2022 compared to data from Q4 2021 show the following: butler’s pantry/working pantries/prep pantries, 53% in 2022, 55% in 2021; outdoor kitchens, 52% in 2022, 55% in 2021; increase in natural lighting, 46% in 2022, 44% in 2021; open to household living spaces, 28% in 2022, 41% in 2021; wine refrigerator/storage, 27% in 2022, 36% in 2021; adaptability/universal design, 27% in 2022, 20% in 2021; double island work/eating areas, 20% in 2022, 24% in 2021; deep pull-out shelves, 18% in 2022, was not asked in 2021; coffee bars, 17% in 2022, 28% in 2021; computer work/recharge area, 17% in 2022, 20% in 2021; recycling center, 16% in 2022, 16% in 2021; pet feeding/grooming area, 13% in 2022, 23% in 2021; and smart/connected kitchen, 12% in 2022, 17% in 2021.

Induction cooking appliances and concealed lighting grew in popularity, topping the list of kitchen products. The percentage of respondents reporting popularity of kitchen products increasing minus those reporting decreasing from Q4 2021 to Q4 2022 showed the following: induction cooking appliances, induction cooking appliances, 57% in 2022, 43% in 2021; concealed and disguised lighting, 36% in 2022, 33% in 2021; drinking water filtration, 33% in 2022, 40% in 2021; upper-end appliances, 31% in 2022, 41% in 2021; undercounter appliances, 30% in 2022, 38% in 2021; smart appliances, 24% in 2022, 23% in 2021; built-in appliances, 22% in 2022, 23% in 2021; duplicate appliances, 20% in 2022, 27% in 2021; steam ovens, 16% in 2022, 22% in 2021; touch-activated faucets, 15% in 2022, 20% in 2021; hands free/sensor faucets, 15% in 2022, 29% in 2021; and mix of countertop materials, 14% in 2022, 15% in 2021.

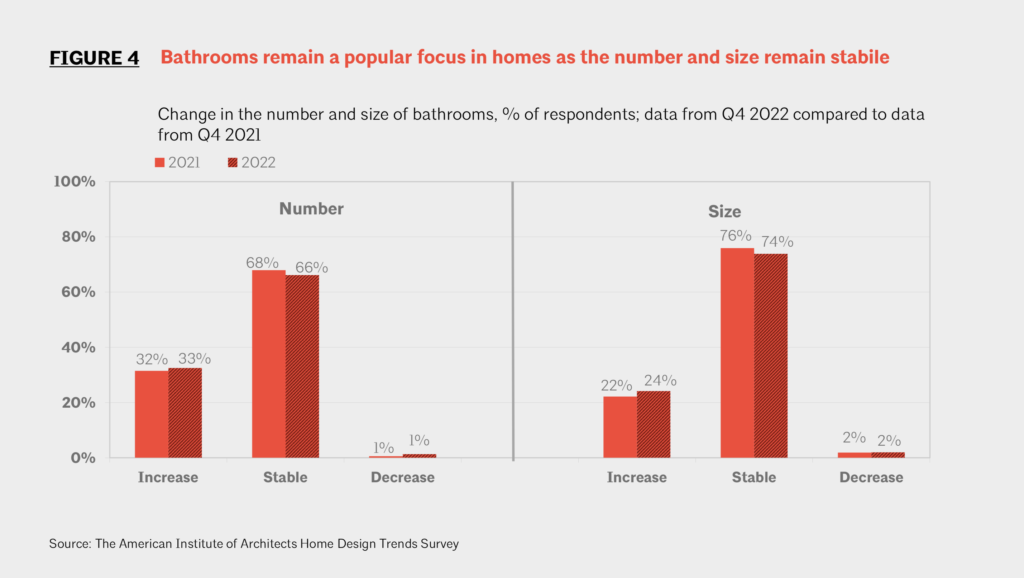

Bathrooms remain a popular focus in homes as the number and size remain stable. The change in the number of bathrooms in Q4 2022 show a 33% increase, 66% stable, and 1% decrease. The size of bathrooms in Q4 2022 show a 24% increase, 74% stable, and 2% decrease.

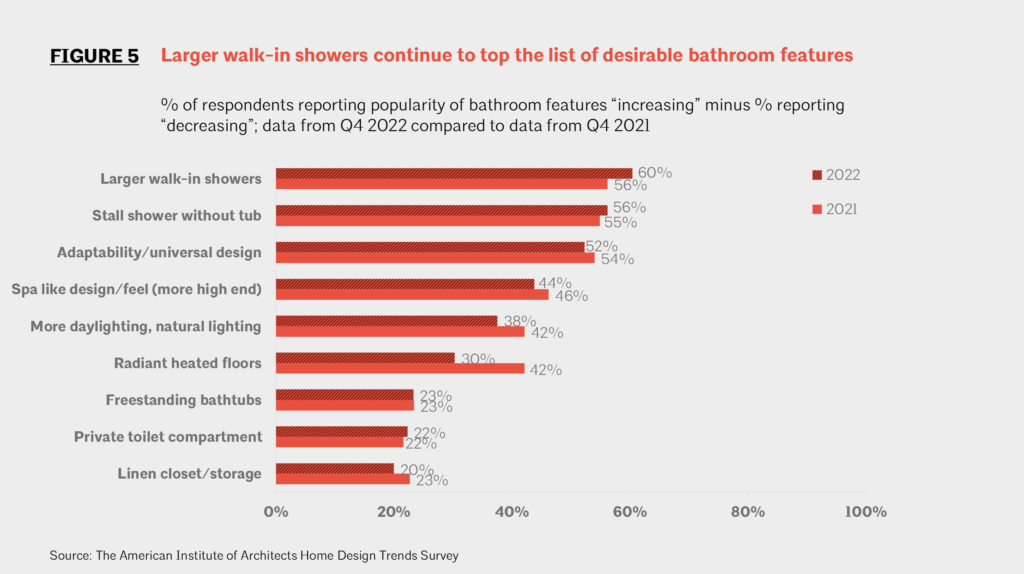

Larger walk-in showers continue to top the list of desirable bathroom features. The percentage of respondents reporting popularity of bathroom features increasing minus the percentage reporting decreasing from Q4 2021 to Q4 2022 showed the following: larger walk-in showers, 60% in 2022, 56% in 2021; stall shower without tub, 56% in 2022, 55% in 2021; adaptability/universal design, 52% in 2022, 54% in 2021; spa-like design/more high-end feel, 44% in 2022, 46% in 2021; more daylighting, natural lighting, 38% in 2022, 42% in 2021; radiant heated floors, 30% in 2022, 42% in 2021; freestanding bathtubs, 23% in 2022, 23% in 2021; private toilet compartment, 22% in 2022, 22% in 2021; and linen closet/storage, 20% in 2022, 23% in 2021.

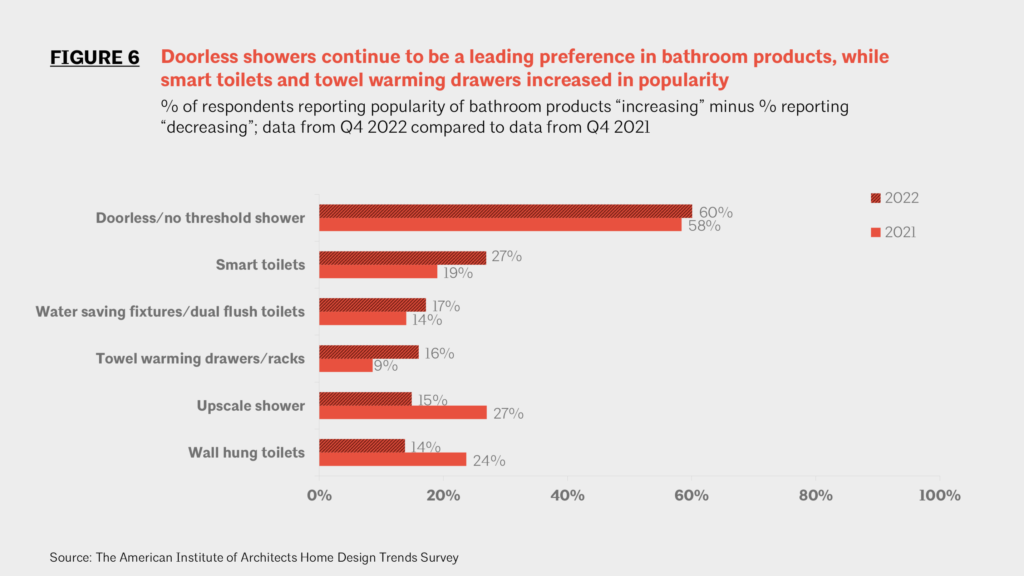

Doorless showers continue to be a leading preference in bathroom products, while smart toilets and towel warming drawers increased in popularity. The percentage of respondents reporting popularity of bathroom products increasing minus the percentage reporting decreasing from Q4 2021 to Q4 2022 showed the following: doorless/no threshold shower, 60% in 2022, 58% in 2021; smart toilets, 27% in 2022, 19% in 2021; water saving fixtures/dual flush toilets, 17% in 2022, 14% in 2021; towel warming drawers/racks, 16% in 2022, 9% in 2021; upscale shower, 15% in 2022, 27% in 2021; and wall-hung toilets, 14% in 2022, 24% in 2021.

Project billings, inquiries, and design contracts showed weakness in Q4. Project backlogs continue to decline from their peak in Q1, but remain near all-time high levels. Firms in all regions report weakness in billing in Q4. New construction weakens, while home improvement sectors see slower growth. The percentage of respondents reporting sector improving minus the percentage reporting weakening from Q4 2021 to Q4 2022 showed the following: remodeling, such as additions/alterations, 27% in 2022, 64% in 2021; remodeling, such as kitchen/bath, 27% in 2022, 66% in 2021; first-time buyer/affordable homes, -38% in 2022, -3% in 2021; move-up homes, -18% in 2022, 29% in 2021; custom/luxury homes, 1% in 2022, 45% in 2021; townhouse/condo, -17% in 2022, 16% in 2021; and second/vacation homes, -12% in 2022, 27% in 2021.